Khalti is Nepal’s second-largest mobile wallet and payment gateway after eSewa. with 1M+ downloads. It is popular for its easy and secure online/mobile payment services. You can use Khalti by registering an account with your mobile number. It is very easy to use Khalti. Here’s is the complete guide on how to create and verify Khalti account.

What is Khalti?

Khalti is one of the most leading digital payment platforms in Nepal. It aims to bring offline services online and make the life of people easier. It has been providing facilities of online payment facilities through its mobile app and web portal.

It provides various utility payment services, mobile recharge, paying electricity and water bills, internet bills, domestic flight ticketing, movie and events ticketing, booking hotels, paying school fees, and more. It offers cashback to its users in almost every transaction.

It has been seen as a rival to eSewa, the leading digital wallet of Nepal. Khalti is aggressively increasing its market in Nepal. Although Khalti doesn’t possess all the services as of eSewa, they are day updating their services day by day. Currently, Currently, Khalti has more than 800,000 users registered on its platform, along with 100,000+ Android app downloads, 5000+ iOS app downloads.

Features of Khalti App

- It provides instant hassle-free online payments.

- You can pay electricity bills without visiting NEA counters.

- It provides Bank link services and easy bank transfer.

- You can TopUp your mobile which includes NTC, Ncell, and SmartCell.

- It offers Credit card payments, EMI, online shopping.

- You can buy movie and flight tickets using Khalti.

- You can pay internet and DTH bills.

- You can pay water easily without visiting the khanepani office.

- It has very supportive Customer Care.

- The services of Khalti can be used through mobile app as well as web portal.

- It is safe, secure and reliable licensed by the Nepal Rastra Bank (NRB).

How to create and verify a Khalti account?

Khalti is available in both web-based services and mobile applications. It is available in both Android and iOS stores. You can download and create your Khalti account by following these steps.

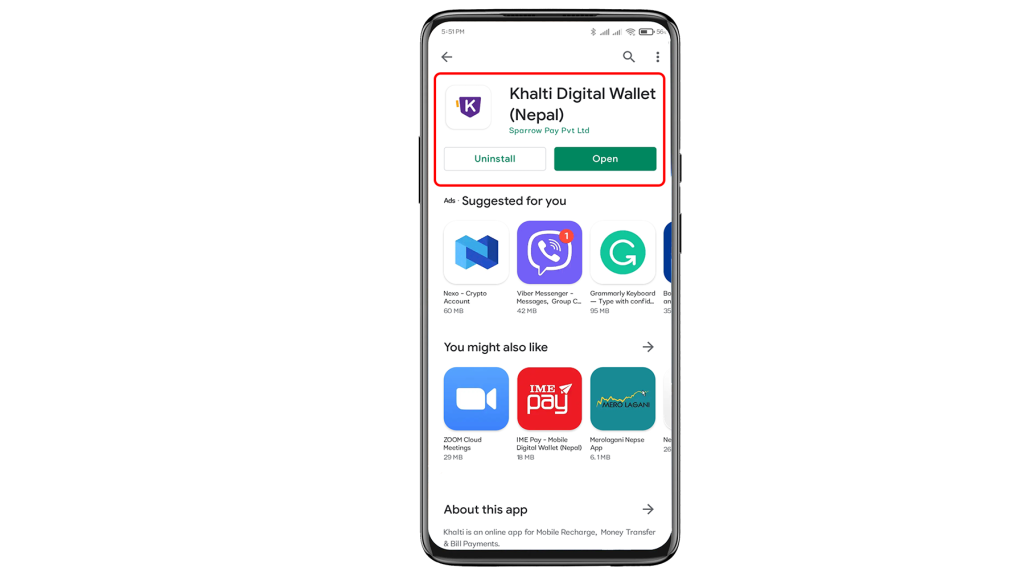

1. Downoad and Install Khalti App.

Click Here to download from the play store.

Click here to download from App Store.

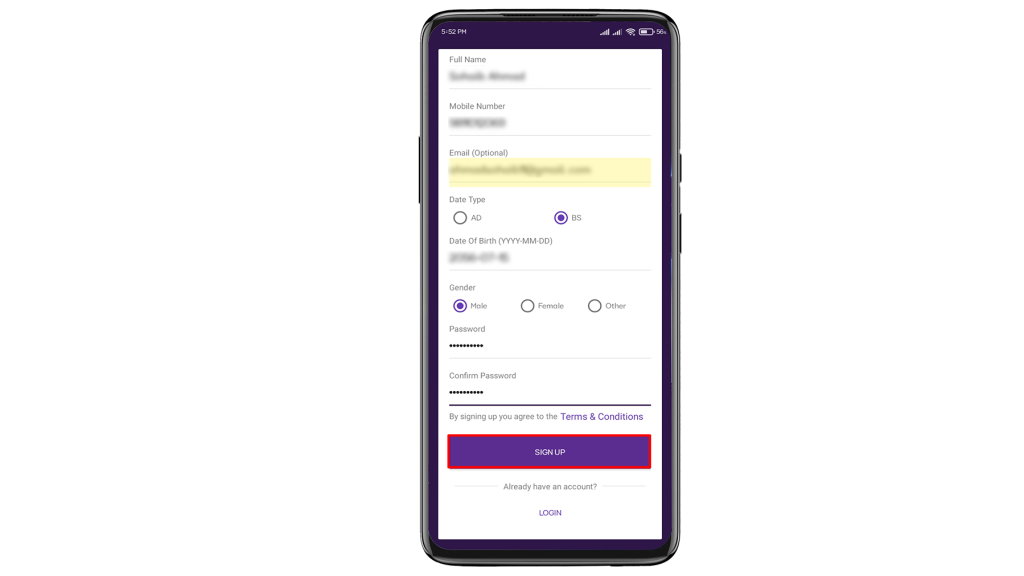

2. Tap on ‘Create Account’ button.

3. Fill the required informations and tap on ‘Sign Up’.

Required Informations

- Full Name

- Mobile number

- Email Address

- Password

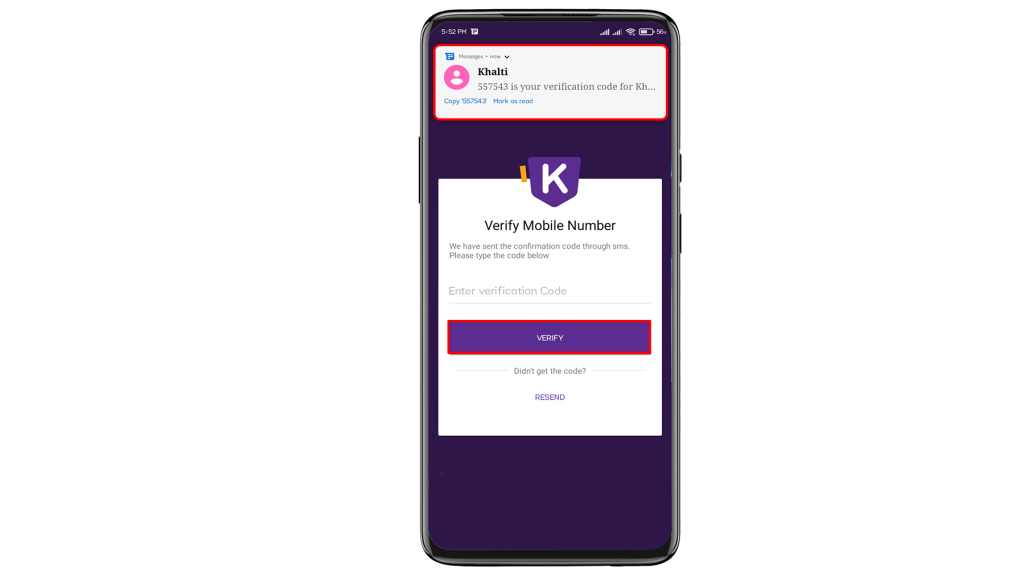

4. Enter the verification code which you will receive in your phone number.

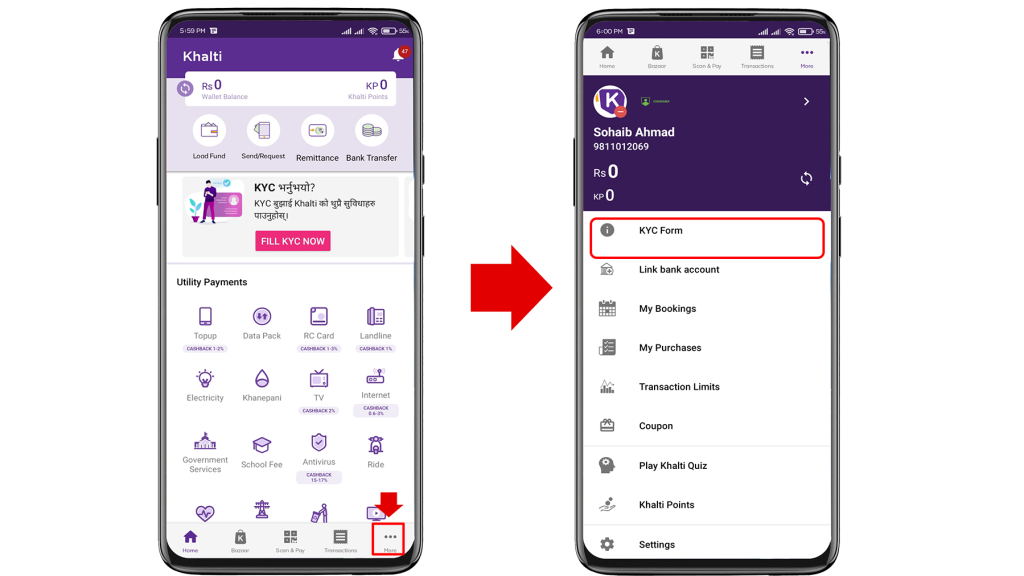

Once you enter the verification code, your account will be created successfully. After you have logged on to Khalti, it is better to do KYC verification. Users who have not verified KYC cannot make transactions of more than Rs 5000.

You can enjoy more of the wide range of services from Khalti and perform transactions of more than Rs 5000 after this. Follow these steps to verify your KYC form:

5. Tap on the ‘More’ button and then ‘KYC form’ from the menu.

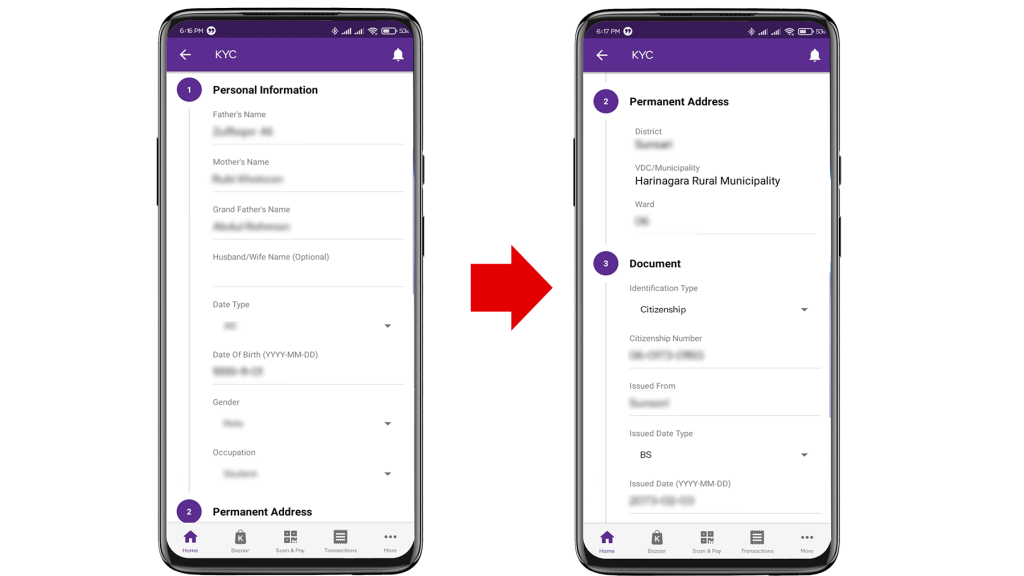

6. Enter the required details in the KYC form.

Details Required:

- Family Information – Father’s name, Mother’s name, Grandfather’s name and Spouse‘s name (if married)

- Personal Information – Date of Birth, Gender, Occupation

- Permanent Address – District, Municipality, Ward

- Identity Information – Identity Type (Citizenship/Driving License/Passport), Identity number, Issued place, Issued date

- Profile picture (Photograph showing the face of the customer)

- Scanned copy of your Identity Card (both front and back)

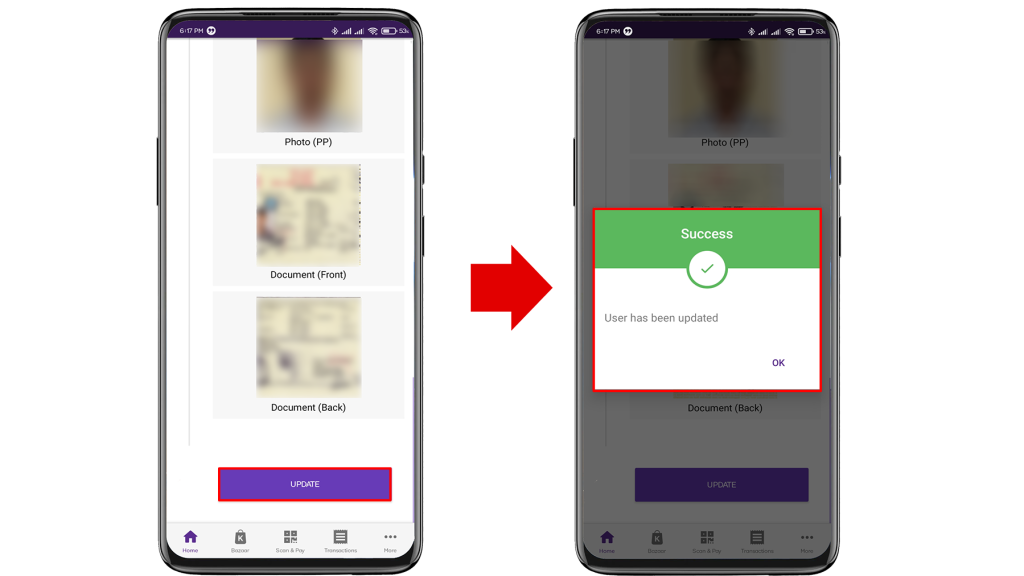

7. Attach the required documents and click on ‘Update’.

Required Documents

- Soft copy of your recent PP size photo

- Scanned copy of any documents (Citizenship/Driving License/Passport)

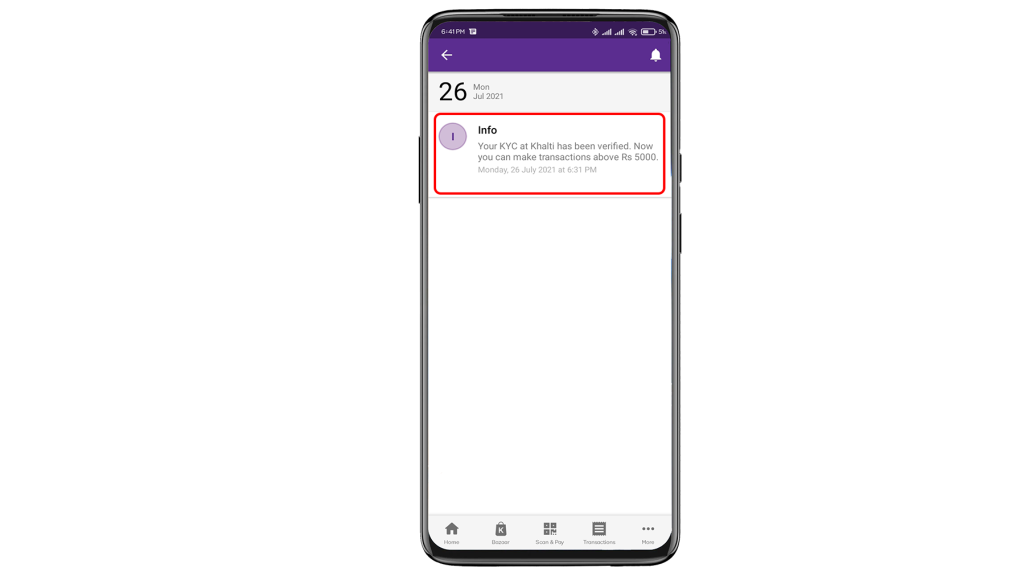

8. You will be notified as soon as your KYC is verified.

You will be verified within 1 to 2 days after submitting the KYC form. The message of verification will be sent to your phone number. You can also check the notification to confirm if you are verified.

In case your KYC is rejected, you can contact us at Toll-Free Number (1660-01-5-8888), Mobile (9801165561) or Email ([email protected])

After your KYC verification,

- You will be able to enjoy a wide range of services and offers.

- You can do a transaction of more than Rs 5000 at a time.

The minimum limit is Rs. 10 and the maximum limit for KYC verified users is Rs. 50,000 at a time, Rs. 100,000 in a day, and Rs. 500,000 in a month. Similarly, for non-KYC verified users, the maximum limit is Rs. 5,000 only.

This is all about creating and verifying your Khalti Account. I hope this article was helpful to you. If you have any queries regarding this topic, do comment on us.

Subscribe to our newsletter for the latest tech news, tips & tricks, and tech reviews.